When stores shut down in March 2020, jewelry brands were at a crossroads. Historically, the industry relied on physical retail to connect with consumers. When the world moved online, retailers had to adapt their businesses to meet a new digital age.

Today, the jewelry market is one of the fastest-growing categories in retail. Sales soared in 2021, with jewelry and watch sales exceeding $115 billion. The industry is expected to reach $307 billion by 2026, driven by China, the US and India.

At the same time, the purchasing power of Millennials and Gen Z is increasing. And how these new generations buy jewelry differs from their parents and grandparents. As the industry navigates a digital-first world, retailers will need to transform their strategies to meet the demands of younger generations.

A New Jewelry-Buying Journey

Although Baby Boomers and Gen X have the greatest purchasing power today, Millennials and Gen Z are gaining ground. As digital natives, these generations prefer speed, convenience and personalization.

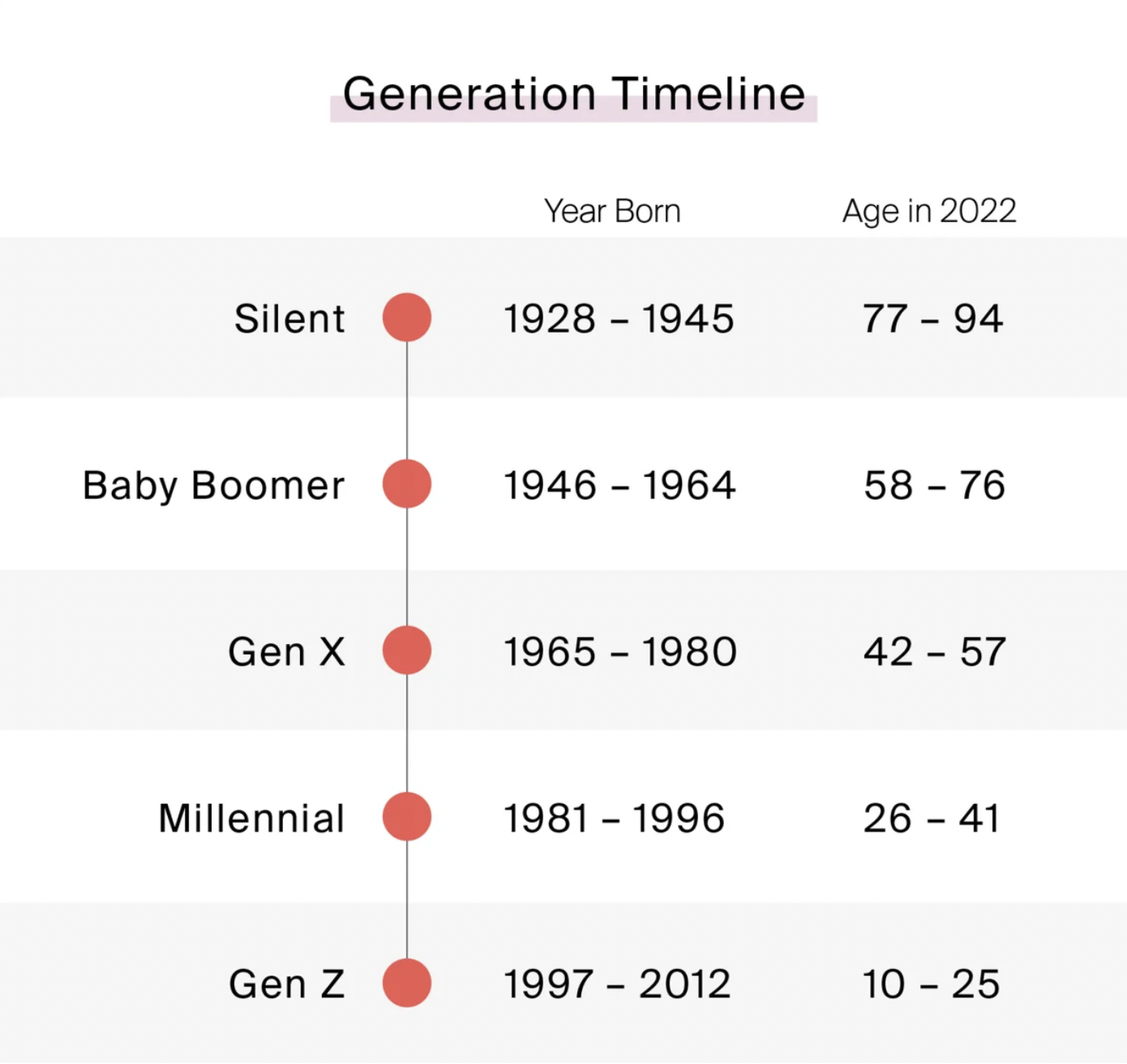

Before we explore how these generations are redefining the industry, let’s review their definitions.

- Millennial: Refers to those born approximately between 1981 and 1996. Millennials are 26 to 41 years old.

- Gen Z: Refers to those born approximately between 1997 and 2012. Gen Z consumers are between 10 and 25 years old.

Digital-First Discovery

Millennial and Gen Z consumers start their jewelry-buying journey online. These generations list social media, YouTube ads and online search as their top channels for inspiration. Brilliant Earth recently reported that 13% of its new customers now originate from TikTok.

Alternatively, Baby Boomers and Gen X consumers turn to TV ads, retail stores and search engines for product discovery.

Jewelry in the age of eCommerce

Over the last three years, jewelry shoppers across generations have grown more comfortable buying online. In 2019, only 13% of fine jewelry sales came from online channels. McKinsey predicts online sales will account for 18% to 21% of the global market by 2025.

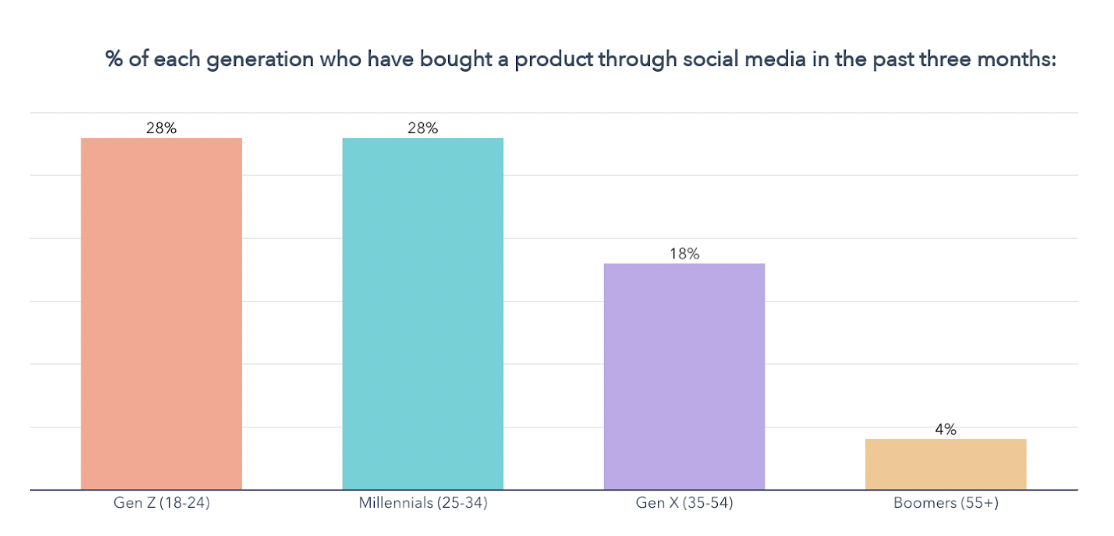

Additionally, social shopping is one of the fastest-growing channels for younger consumers. Today, 64% of Gen Z and 58% of Millennial consumers have purchased an item on a social media platform.

Alternatively, older generations have been slow to adopt social shopping. While 90% of Gen X consumers use social media, only 18% have purchased on a social platform.

The role of physical retail

Despite the increase in eCommerce, 72% of jewelry purchases still occur in a physical store. But the reasons for visiting a store vary by generation.

Baby Boomers and Gen X consumers prefer stores for browsing. For younger generations, physical retail meets the need for speed and convenience. Seventy-five percent of Gen Z consumers prioritize fast shipping over brand name recognition.

The Rise of the Metaverse and Web 3.0

The last two years have also seen the rise of the metaverse. For jewelry brands, the metaverse isn’t only an opportunity to capture younger consumers. It also allows retailers to tap into what the industry does best—create meaningful personal experiences.

Syama Meagher, CEO and Chief Retail Strategist at Scaling Retail, spoke with National Jeweler about the metaverse’s potential to transform the industry. “Jewelry is the perfect category for the metaverse. It is collectible by nature, perfect for collaborations and carries more brand loyalty than clothing,” she says.

Last year, Tiffany’s released a collection of 250 digital passes that customers could redeem for a custom pendant and NFT digital artwork. The limited supply sold out in less than thirty minutes and brought in $12 million for the retailer.

Meeting new gender norms

Younger generations’ attitudes about gender roles are also changing the industry.

First, more women are investing in luxury pieces for themselves. Seventy-two percent of those who purchased diamonds for themselves in the last two years were women, up from 51% in 2018.

Gender-neutral jewelry is also growing as a category. Earlier this year, Tiffany & Co. released its Tiffany Lock campaign. With four gender-neutral bracelets, the campaign’s motto is “No Rules. All Welcome.”

Supporting shifting gender norms is crucial for retailers to capture younger customers. Today, 42% of Gen Z consumers are more likely to purchase from brands that advocate for gender equality.

The value of sustainability

Across generations, consumers rank sustainability as a critical factor when purchasing jewelry. Jewelry is the third most frequently purchased category—after food and clothing—based on environmental practices.

Consumers expect more than a verbal commitment to sustainability. De Beers Group found that 56% of consumers are willing to pay a premium for sustainability credentials.

This demand for authenticity skews younger. Only 8% of Baby Boomers prefer to buy jewelry with credentials, compared to 30% of Millennials and 21% of Gen Z shoppers.

The growth of resale

Once shunned by luxury consumers, pre-owned pieces are the jewelry industry’s fastest-growing segment. By 2025, the resale jewelry market is expected to exceed $30 billion.

“Resale has undeniably gone mainstream, and the luxury sector has one distinction that sets it apart: every demographic actively participates in luxury resale,” writes Rati Sahi Levesque, President at The RealReal, in the company’s 2022 Luxury Consignment Report.

While all generations engage with selling and purchasing pre-owned products, Gen Z is most likely to keep it circular. Twenty-three percent of Gen Z consumers choose site credit when selling jewelry online.

For jewelry brands, preowned channels are an opportunity to reach younger consumers at more affordable price points. By engaging with younger generations early, luxury jewelry retailers drive brand awareness and increase lifetime customer value.

How Salesfloor Supports the Jewelry Shopping Journey Across Generations

Salesfloor supports jewelry brands as they look to offer memorable and personalized experiences to customers of all ages.

Salesfloor is the only retail platform to unify the jewelry shopping journey with virtual shopping, clienteling and AI. Our Appointment Booking tool allows customers to schedule 1:1s with their favorite associates—virtually or in person. And associates can use Personalized Lookbooks to suggest products based on consumer preferences and purchasing history.

Book a demo today to see how jewelry brands meet the demands of all generations with the Salesfloor platform.